Delivered exclusively by True Rewards, part of iGoDirect, Web-to-Wallet seamlessly pushes digital prepaid cards from a web browser directly to Apple and Google wallets. As a card issuer, this provides iGo with additional capabilities to tokenise cards instantly without having to use a mobile application.

This is a massive milestone for iGoDirect Group and what we believe to be a game-changer in prepaid and gift card deployment. Our mission has always been to make it easier and faster for companies to reward their customers and employees. The launch of Web-to-Wallet demonstrates our commitment to innovate and differentiate from the market.

1. Web-to-Wallet solves the customer’s pain point about app downloads, bringing in new potential customers

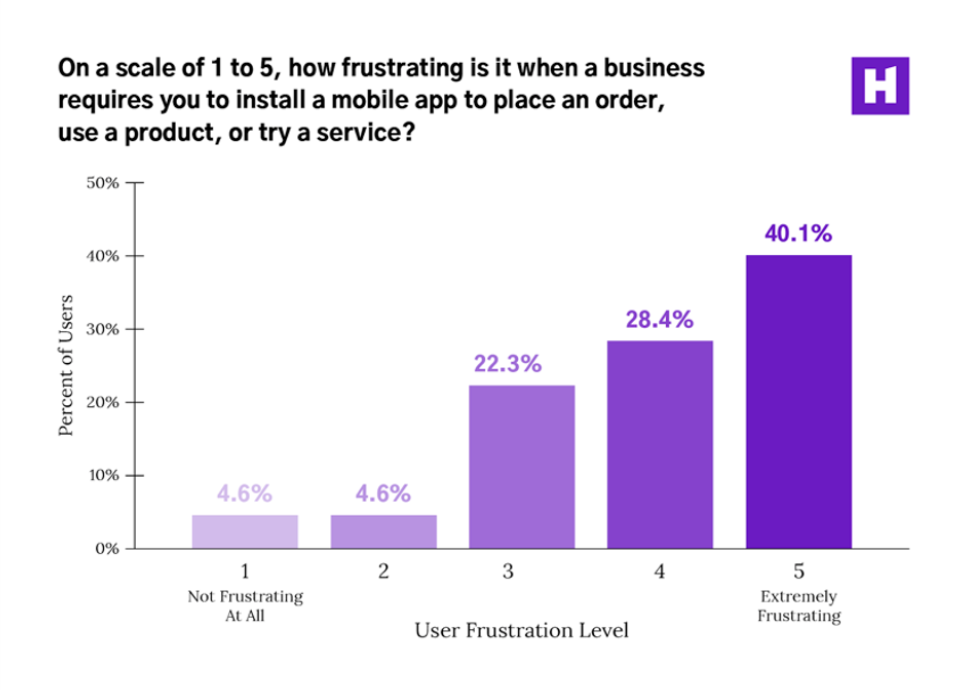

Did you know that most of us hate being forced to install apps to do business? According to a survey by Heady.io, over 90% of people are frustrated when a business requires an app download. In particular, younger people, who are more active digital wallet users, are more likely to abandon transactions if required to install an app.

By forcing customers to install an app to place an order, access a product or service, this causes friction in the customer experience and can cost brands billions.

The same frictionless experience is demanded by customers when it comes to payments, with digital wallets continuously growing in usage and familiarity across the world. The ‘Bank On It’ Report shows that Australians are leading the charge, having made $126 billion in payments with their digital wallets in 2024 alone.

The same frictionless experience is demanded by customers when it comes to payments, with digital wallets continuously growing in usage and familiarity across the world. The ‘Bank On It’ Report shows that Australians are leading the charge, having made $126 billion in payments with their digital wallets in 2024 alone.

“Growing familiarity with digital wallets created demand for a solution that enables iGoDirect customers to quickly and easily provision virtual cards and digital wallet tokens from the web for use with both Apple Pay and Google Pay,” said iGoDirect Chief Operations Officer Pat Dalton. “Our web push provisioning product meets that need and helps enable our customers to deliver a streamlined checkout experience to their end users.”

2. Web-to-Wallet offers a faster, more secure experience for cardholders

Currently in the market, there are two primary ways for consumers to add cards to digital wallets – Manual Entry and Push Provisioning. Read our blog to learn about the differences.

Manual method poses a security risk for cardholders and brands as the provision of physical cards is manually added to digital wallets. Cardholders need to expose the Card PAN from the physical card and necessary card details into their digital wallet which anyone could do if they have the card.

Web-to-Wallet is different from both Manual Entry and In-App Provisioning in several ways. With Manual Entry, the user must work within the digital wallet app and manually enter their payment card information or take a photo of the card.

However, with Web-to-Wallet, the user does not need to work within their digital wallet app and can instead scan a QR code or click on a link to add their payment card to their digital wallet.

3. Web-to-Wallet saves development time and costs

As reiterated, users do not need to download, install, and open a custom application just to add a card from that provider to their digital wallet.

This also means that businesses do not need to develop a mobile application, and the user is not required to work within the mobile app environment.

Instead, Web-to-Wallet allows developers to build for the browser, reducing both the development time and the friction of the user experience.

With iGoDirect, we can help businesses fully white-label the user journey from activating to accessing the card, showcasing the client’s brand from end-to-end

Interested in understanding how our solution may help your business? Get in touch us today to speak to our payment experts and experience Web-to-Wallet™ first-hand.

Cards WITH Web-to-Wallet | Cards WITHOUT Web-to-Wallet |

|---|---|

No app downloads / installs | Need to download third-party apps |

Web Push Provisioning - users add cards to their wallet with a few clicks | Manual entry - users enter card details manually with more steps involved |

Users access a simple web portal to manage cards | Users need to download a mobile app to check card status |

Web portal can be white-labelled with minimal development | Extensive development needed for white-labelling |