In the past decade, loyalty programs have come a long way—from paper punch cards to plastic cards to apps and QR codes. But today, the game is changing once again.

The proliferation of mobile wallets like Apple Pay and Google Wallet is redefining how consumers store, access, and engage with their rewards—and savvy brands are taking note. In Australia:

The future of loyalty is not an app.

It’s your brand in your customer’s mobile wallet.

Mobile Wallets Are Everywhere—and Growing Fast

From coffee shops to corporate cashback programs, consumers are increasingly using mobile wallets to store payment cards, tickets, IDs, and loyalty credentials. According to the Australian Banking Association, more than 50% of smartphone users in Australia are now active wallet users—and that number is climbing.

Why mobile wallets are booming:

- Contactless convenience: Tap-to-pay is now an everyday habit.

- Always accessible: Rewards and cards live right on the phone.

- No app fatigue: Consumers don’t want to download yet another app.

- Instant gratification: Rewards can be delivered and redeemed in seconds.

For brands, mobile wallet rewards represent a direct, always-on channel to your customer—one that’s frictionless, real-time, and more cost-effective than traditional loyalty platforms.

Wallet-Based Loyalty: A Smarter Way to Engage

Traditional loyalty programs often suffer from low engagement, complex redemption processes, and a disconnect between the reward and the customer experience.

A wallet-first approach turns that model on its head by delivering rewards that are:

- Instantly usable (no points accumulation needed)

- Highly visible (your card is front and centre in the customer’s wallet)

- Continuously engaging (through card-linked merchant offers and reloadable value)

- Effortless to deploy and scale (no app development required)

It’s loyalty that lives where your customers already are—on their phones, in their wallets, ready to use.

How iGoDirect Powers Wallet-First Loyalty

At iGoDirect, we’ve built an integrated platform that puts wallet-first engagement at the heart of your loyalty strategy. Here’s how:

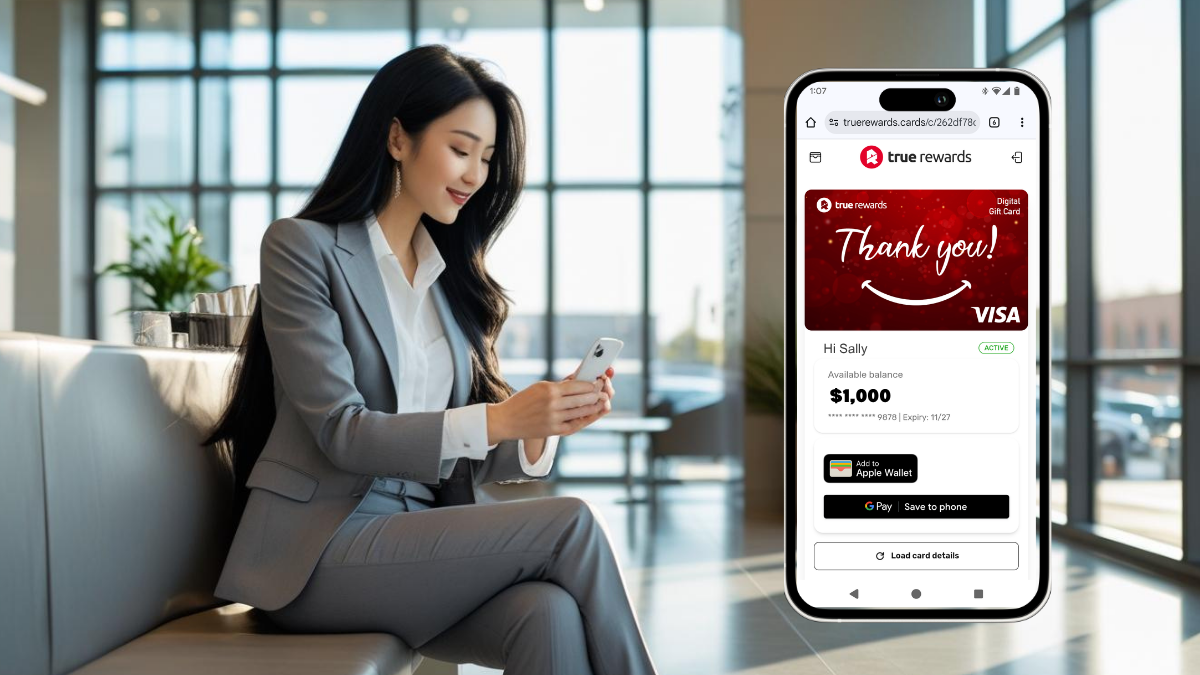

Digital Visa Card Issuing

Digital Visa Card Issuing

Issue branded digital Visa prepaid cards in real time to reward customers, employees, or channel partners. These cards are:

- Reloadable or single-use

- Fully customisable with your brand

- Spendable anywhere Visa is accepted (online and in-store)

- Restricted spending (merchant category codes, merchant IDs)

Web Push Provisioning and Card Management

Web Push Provisioning and Card Management

Enable users to instantly add their digital prepaid cards to Apple Pay or Google Pay with a single tap—no app downloads, no clunky activation process. It’s a seamless experience that reduces drop-off and boosts usage.

In addition, users receive access to a (branded) card management portal where they can:

- View all associated cards balances and expiry

- View transaction history

- View cashback earnings

- Upload/scan receipt for validation

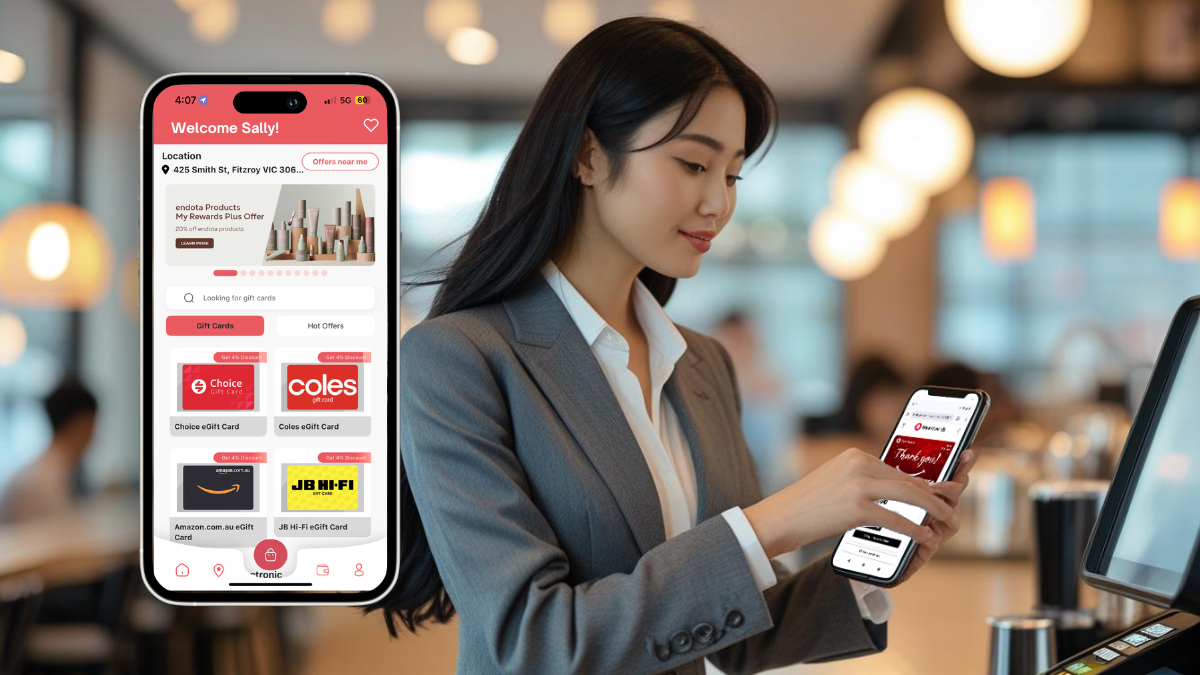

Mobile Passes: A New Layer of Engagement in the Wallet

Mobile Passes: A New Layer of Engagement in the Wallet

Beyond digital prepaid cards, mobile passes— used for loyalty, membership and special offers —can also be stored directly in Apple Pay and Google Pay, giving brands a powerful, low-friction way to stay connected with customers.

In conjunction with digital Visa cards, you can issue dynamic, companion mobile passes that serve as membership IDs, promotional coupons and event tickets.

What makes mobile passes so powerful is their dynamic functionality—you can push updates to the pass in real-time, such as:

- Adding new promotions

- Setting offer expiry dates

- Updating branding or messaging

- Geo-fenced push notifications to customers

Card-Linked Merchant Offers

Card-Linked Merchant Offers

Cashback and discount taps into a mix of behavioural economics, reward theory, and consumer psychology—making them effective and gratifying incentives in marketing and loyalty.

Top off your loyalty program with automatic cashback or discounts at selected retailers, linked to your branded digital Visa card. This not only increases reward usage but encourages habitual engagement with your brand.

Turn Rewards into Relationships

Turn Rewards into Relationships

By combining these capabilities, iGoDirect helps you transform one-off rewards into ongoing customer engagement and loyalty program. Your brand becomes a daily utility, a source of value, and a presence in your customer’s everyday financial activity.

No plastic. No points. No friction.

Just real rewards, real value, delivered straight to the wallet.

The Bottom Line

The Bottom Line

Mobile wallets are no longer a trend—they’re the new norm.

If your loyalty strategy doesn’t live in your customer’s wallet, it’s time to rethink it.

With iGoDirect’s wallet-first platform, you can:

- Launch instantly accessible loyalty and incentive programs

- Reduce complexity for your customers

- Increase redemption and engagement rates

- Build long-term brand loyalty in a modern, scalable way

Want to see it in action?

Let’s chat about how we can build a wallet-first loyalty experience tailored to your brand.

Get in touch today for a consultation.